What Must A Solicitor Do In Respect To Money Laundering Checks

On 19 September 2014, Wu Wing Kit (Wu), a solicitor and partner of Hong Kong law firm, Fred Kan & Co (FKC), was sentenced to 6 years’ imprisonment for money laundering. This case highlights the importance of solicitors carrying out due diligence in respect of their clients’ identity and the transactions instructed to be carried out, in particular, the source of any funds that are to pass through or be held in the solicitor’s bank accounts, and if there are grounds to support a suspicion, solicitors should make a report to the Joint Financial Intelligence Unit (JFIU).Section 25 of Organized and Serious Crimes Ordinance (Cap. Privacy Policy Statement1. Personal Data (Privacy) OrdinanceDeacons complies with the Personal Data (Privacy) Ordinance ('Ordinance'). You may wish to visit the official website of the Office of the Privacy Commission for more information about this Ordinance.2. Your personal dataIt is our policy to protect the privacy of users of the Website. We may, however, collect a very limited amount of your personal data (by 'personal data', we mean information about you or which can be used to ascertain your identity).

- What Must A Solicitor Do In Respect To Money Laundering Checks Work

- Law Society Aml Guidance For The Legal Sector

For example, we may collect some information about you when you visit the Website because your internet provider address needs to be recognised by our server. You will also be invited to provide some information about yourself on various pages of the Website. We do not use 'cookies'.3. Collection and use of your personal dataAny personal data collected from you on the Website will only be used for the specific purposes mentioned at the time of collection or for purposes directly related to those specific purposes and/or in Deacons'.4.

Direct marketingWe would like to use your name and contact details to send you marketing materials about our legal services and/or related products but we must obtain the consent (or an indication of no objection) of people who become our clients or staff before we can do so. If you do not want to receive our marketing materials, please send an email stating this to jayson.williams@deacons.com. More information about this can be found in our Personal Information Collection Statement.5. Retention of your personal dataWe will retain your personal data only for so long as is necessary for fulfilling the purpose for which they were collected.

After that time, you data will be erased.6. DisclosureYour personal data will generally be kept confidential and will not be disclosed to any other person without your consent. However, your data will be used (and disclosed) to third parties for the purposes for which they were collected. Your personal data may also be disclosed where we are required to do so by law. Please also refer to our t as appropriate, for details7. SecurityWe have installed security systems to ensure your personal data are not subject to unauthorised access.8.

Your right of access to and to correct personal dataYou are entitled, in accordance with the Ordinance, to check whether we hold data about you and to have access to those data. If any of these data are incorrect or inaccurate, you have the right to correct or update them.

Requests for access to or to correct personal data should be addressed to The Chief Operating Officer, Deacons. In accordance with the Ordinance, we are entitled to charge a reasonable fee for processing any data access or correction requests.9. Cookie usage policyCookies are small text files that are downloaded to your device by websites you visit. The information that the cookies collect, such as the number of visitors to the site, the pages visited and the length of time spent on the site, is aggregated and therefore anonymous.We also use software that places a cookie on your device to understand whether you read the emails and other materials, such as legal publications, that we send to you, click on the links to the information that we include in them and whether and how you visit our website after you click on that link (immediately and on future visits). It records this activity against your email address.You may refuse the use of cookies or withdraw your consent at any time by selecting the appropriate settings on your browser. Please note that removal of cookies may affect your use and experience of our website.By continuing to use our website without changing your privacy settings, you are agreeing to our use of cookies. To find out more about cookies, including how to manage and delete them, visit.Copyright©2018, Deacons All rights reserved.

BE SURE TO READ THE TERMS AND CONDITIONS BELOW (‘TERMS OF USE'), AS THEY APPLY TO YOUR USE OF THIS WEBSITE (THE 'WEBSITE') AND CONTROL ALL ASPECTS OF YOUR ACCESS TO AND USE OF THE WEBSITE.If you do not accept these Terms of Use in full, the use of the Website must be terminated immediately.The Website presents information, data, content, news, reports, programs, video, audio and other materials and services including e-mail alert service, communications, transmissions and other items, tangible or intangible (collectively, the 'Information').1. Change of Terms.Deacons ('us', 'we', 'our') may change the Terms of Use from time to time in our sole discretion without notice or liability to you.

By continuing to use the Website following such modifications to the Terms of Use, you agree to be bound by such modifications2. Changes to Website.We may, at our absolute discretion and at any time, without prior notice to you, add to, amend or remove material from the Website, or alter the presentation, substance, or functionality of the Website.3.

MONEY LAUNDERINGProceeds of Crime Act 2002; Terrorism Act 2000; Money Laundering Regulations 2003Guidance for NotariesThese notes are a concise guide to the provisions of the Proceedsof Crime Act 2002 (POCA), the Money Laundering Regulations 2003and the Terrorism Act 2000 as they affect notaries in England andWales; they will be revised from time to time. The purpose of thenotes is to assist notaries and their employees in understandingtheir duties under this important legislation. In the course ofthese notes reference will be made to specific guidance issued byother professional or industry bodies where these are consideredrelevant to particular issues arising in notarial practice. In viewof the fact that many notaries also practise as solicitors, guidanceissued from time to time by the Law Society of England and Walesis of particular relevance and it is contemplated that a solicitor- notary when carrying out legal work which has no special notarialaspect would do so as a solicitor and in accordance with guidelinesapplicable to that profession. A RISK-BASED APPROACHThroughout this guidance emphasis will be placed on the benefitsof a risk-based approach to money laundering and terrorismissues. A practice that takes a risk-based approach managesits affairs with regard to the risks of the practice beingused for money laundering or terrorist financing and monitorsthe effectiveness of the controls it has put in place to managethese risks.A risk-based approach takes a number of discrete stepsin assessing the most cost effective and proportionate wayto manage and mitigate the money laundering and terroristfinancing risks faced by the practice. These steps are toidentify the money laundering and terrorist financing risksthat are relevant to the practice; assess the risks presentedby the practice's particular clients, specialisms and location;design and implement controls to manage and mitigate theseassessed risks; monitor and improve the effective operationof these controls and to record appropriately what has beendone and why.How a risk-based approach is implemented will also dependon a practice's size and structure.

Different considerationswill apply to a sole practitioner in a rural practice thanto a multi-partner firm with an inner-city location. A risk-basedapproach starts with the identification and assessment ofthe risk that has to be managed. A practice should assessits risks in the context of how it might most likely beinvolved in money laundering or terrorist financing. Oncea practice has identified and assessed the risks it facesin respect of money laundering or terrorist financing, itmust ensure that procedures to manage and mitigate theserisks are designed and implementedSection 1 (Introduction).(i) BackgroundPart 7 of the Proceeds of Crime Act 2002, consolidated,updated and reformed the criminal law in the United Kingdomwith regard to money laundering. Other parts of the Act createdthe Assets Recovery Agency (ARA), consolidated existing lawson the confiscation of assets derived from criminal conduct,and introduced new powers to recover criminal assets throughcivil proceedings. Part III of the Terrorism Act 2000 createsa number of offences in relation to terrorism and the fundingof terrorism.

The Money Laundering Regulations 2003 requirenotaries to introduce systems and training to prevent moneylaundering and, except in the case of sole practitioners, designatea 'Nominated Officer' to whom suspicious transactionsmust be reported.The legislation is designed to prevent the proceedsof unlawful activities being legitimised by being applied tocarry out apparently legitimate transactions. It takes a verywide definition of criminal conduct, including all conduct whichconstitutes an offence in any part of the United Kingdom, notjust specific offences such as drug trafficking, terrorism andfraud. The definition also includes conduct which occurs overseaswhich would constitute an offence in the UK and thus includestax evasion and the evasion of tax in jurisdictions outsidethe UK. In relation to certain categories of offences occurringoverseas, the position has been altered by section 102 of theSerious Organised Crime and Police Act 2005 which provides anew defence to the money laundering offences under POCA. Thedefence applies where a person knows or believes on reasonablegrounds that the acts which produced the proceeds took placein a particular country overseas and the acts were lawful inthat country.

In accordance with the Proceeds of Crime Act 2002(Money Laundering: Exceptions to Overseas Conduct Defence) Order2006 (SI 2006/1070), the defence applies only if the act generatingthe proceeds would not be punishable in the United Kingdom bya maximum sentence of more than 12 months' imprisonment. TheOrder sets out a few exceptions to this rule.There are also requirements for certain businessesand professions falling within the scope of the 'regulated sector'to report suspected money laundering to the authorities. Itis important to note that the test of whether or not a transactionshould be reported is an objective one - that is to say it dependsnot on whether the notary actually knows or suspects that moneylaundering is involved, but whether he had reasonable groundsfor such knowledge or suspicion.

There is not a de minimis limitassociated with these provisions, and it is not relevant whenthe criminal conduct took place. Routine transactions may fallinto this wide pool of business and may easily form part ofa money laundering scheme.(ii) Circumstances in which a notary maybe at risk of being used for money launderingThere are three acknowledged phases to money laundering:.Placement - this occurs when cash generatedfrom crime is initially placed in the financial system. As manycrimes generate cash, this is the point at which the proceedsof crime are most apparent and at risk of detection. As banksand financial institutions have developed anti-money launderingprocedures, criminals have to look for other ways of placingcash within the financial system. Entities which commonly dealwith client money, such as law practices, have increasinglybecome at risk of being targeted to deal with cash. Practicesshould decide whether to operate a policy which limits the amountof cash they will accept (except for good reason), and explainthat to clients. This policy should apply even where cash istendered in payment of fees and disbursements.

What Must A Solicitor Do In Respect To Money Laundering Checks Work

However, theplacement stage may not always involve cash - it will dependon the nature of the predicate offence.Layering - after the proceeds of crimehave been placed into the financial system, layering occurswhen the money passes through a series of complex transactionsin order to obscure the origin. These transactions often involvedifferent entities, such as companies and trusts and can takeplace in multiple jurisdictions. Notary practices are at riskof being targeted to assist in money laundering at this stage,although detection can be more difficult.Integration - The criminal wishes tobe able to use his funds without fear of detection and thusneeds to integrate them into the financial system to give themthe appearance of legitimacy. Once the origin of the funds hasbeen obscured, the funds can reappear as legitimate funds orassets.

At this stage the criminals will invest funds in legitimatebusinesses or other forms of investment. Legal professionalswill often be used in this process, for example through buyinga property, setting up a trust or acquiring a company. Thisis not an exhaustive list. Note: Tax avoidance is the legal utilisationof the tax regime to one's own advantage, in order to reducethe amount of tax that is payable by means that are within thelaw. Examples of tax avoidance involve using tax deductionsor changing one's tax status through incorporation; dependingon the legal regime applicable to the tax payer, it might evenextend to establishing an offshore company, trust or foundationin a tax haven.

By contrast tax evasion is the general termfor efforts by individuals, firms, trusts and other entitiesto evade the payment of taxes by illegal means. Tax evasionusually entails taxpayers deliberately misrepresenting or concealingthe true state of their affairs to the tax authorities to reducetheir tax liability, and includes, in particular, dishonesttax reporting (such as under declaring income, profits or gains;or overstating deductions).Generally, the notary should be wary of business structures whichappear abnormal, unduly complicated or are outside his professionalexperience; in the latter case he should decline to act.c. Probate.Although this is much less likely to be an area of concern,money laundering issues may arise. Unusual instructions from beneficiariesor legatees regarding the payment of funds to their order shouldbe reviewed, particularly if the sums are in any way substantial.There may also be tax issues, for example where the deceased under-declaredhis income during his lifetime. Also, it may become apparent duringthe winding-up of an estate that certain assets represent the proceedsof acquisitive crimes committed by the deceased. As was mentionedin paragraph 1(i) for the purposes of the anti-money launderingregime it is irrelevant how long ago the criminal conduct took place.d. Investment Business.This activity, although unlikely to have any relevance to ordinarynotarial practice, is specifically defined as a regulated activityby the Money Laundering Regulations and must always be handled withparticular care.5.3 What checks should be made on client funding?Where you are substantively involved in the planning or executionof a transaction, it is recommended that you take appropriate stepsto check the source of funds.5.4 How do I go about checking the source of a client's funds?There is a simple flowchart attached to these notes under sections7 and 8.

Use them to help your checking system. Extra enquiriesare needed if the funds are provided in cash, bank drafts or thirdparty cheques. Be alert to last minute changes to the source offunds - this is a common ploy used by money launderers.5.5 Is it ever safe to accept cash?Yes - if you are told at the start about cash being used by theclient and you have made reasonable enquiries about the reasonswhy the client is using cash and its source. However, you may wishto establish a policy limiting the amount which you will accept.Record the explanations and your reasons for being satisfied inthe particular circumstances.5.6 How can I minimise the risk of assisting in the carryingout of a transaction involving money-laundering?Knowing your customer, understanding and complying with the requirementsof the Proceeds of Crime Act 2002 and the Regulations is the surestrecipe for minimizing the risk. Additionally, you should make afull note of your enquiries and answers in connection with clientidentification and (where relevant) source of funds and of coursekeep copies of relevant documents. Ask all the relevant questionsat the earliest stage of any transaction.

Law Society Aml Guidance For The Legal Sector

If you are instructedby an existing client after some years without contact, recheckthe whole position. If you receive regular instructions from thesame client, consider whether there is any pattern to these instructionswhich might give rise to suspicion, particularly if you are notsure of the underlying background. Be sure to enquire as to theclient's general financial background, and specifically check theintended source of funds to be produced later in the transaction.Emphasise the fact that changes late in the day may affect yourability to proceed with the matter.

Include a reference to thisin your Terms of Business letter.You should also make a note of any concerns which you may haveraised at the time and fully record the client's response. Thisrecord is important to you and may in fact become very significantat a much later date in circumstances where criminal investigationsare being carried out or you have to satisfy a court that you actedreasonably in not making a disclosure. Your notes should state anyreasons why no disclosure was made.Verifying identity5.7 Do I have to identify clients?Yes. Refer to paragraph 4(i) above. Quite apart from your obligationsunder the Practice Rules, if, when carrying out Relevant Businessas defined by Regulation 2 (2), satisfactory evidence of the identityof new clients in compliance with the Regulations is not obtainedyou must not proceed with the transaction, activity or businessrelationship.

Note, however, the transitional provisions in theRegulations (r. Note: documents differ in their integrity, reliabilityand independence - for example greater reliance may be placedon a document issued by a government department (such as a passportor driver's licence) than by a private organization such asa utility provider. Note - The assessment is made by reference tothe information available at the time, the individual's experienceand awareness, actions and inquiries, training given and comparisonto a peer group, 'the reasonably competent notary'.It is therefore important to take all reasonable steps to knowyour client's business circumstances and understand the underlyingreasons for the transactions. In this connection, it may behelpful to refer to guidance issued by other legal professionalbodies, and in particular you are referred to paragraphs 6.35- 6.48 of the pilot money laundering guidance issued to solicitorsby the Law Society of England and Wales.If you disclose your suspicions to your Nominated Officer and recordthe fact that is your responsibility concluded.

The Nominated Officerhas to consider the whole position and disclose the position ornot to SOCA, according to the situation. You must not proceed withthe transaction without the consent of the Nominated Officer.If you are a sole practitioner you must report directly to SOCA. DO NOT TELL ANYONE OTHER THAN THE NOMINATED OFFICER THATYOU HAVE MADE A REPORT OR DISCUSS MAKING A REPORT WITH YOURCLIENT. Tipping off is an offence under the Proceeds ofCrime Act 2002, section 333. Refer to paragraph 5.22 below.Note that there are exception under POCA ss.

333 and 342 tothe tipping off offences which apply to 'professional legaladvisers'. These exceptions are covered in detail in thepilot money laundering guidance issued by the Law Society ofEngland Wales www.lawsociety.org.uk (see paras. 4.59 et seq.),but notaries should be wary of relying on these exceptions sincetheir role will often be that of independent certifying officersrather than of legal advisers.5.17 What does the Nominated Officer have to do?Consider all such reports and any other relevant information anddecide if this gives rise to a knowledge or suspicion of money launderingor reasonable grounds for such knowledge or suspicion. If so passthat information to SOCA.

Keep a record of what he/she decides todo and why. Copies of reports submitted and notes of any contactswith SOCA should of course be kept; as recommended above (see paragraph5.6), these should be stored separately from the client's file.5.18 How should a disclosure to SOCA be made?Although no reporting format is currently prescribed, SOCA's preferredmethod is for reporters to submit their suspicions on the SOCA SuspiciousActivity Report (SAR) Format.

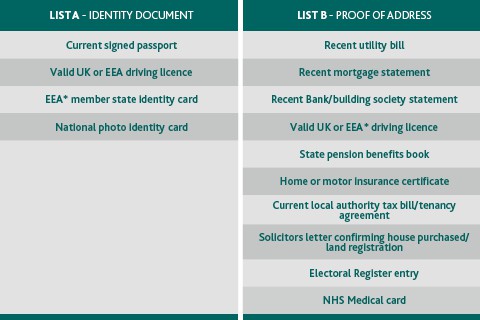

The form can be downloaded from theSOCA website www.soca.gov.uk where advice on its completion willbe found. Note: Subject to compliance withthe Notaries Practice Rules, the question of whether or notan ID document (or a combination of documents) is satisfactoryevidence of the client's identity for the purposes of the Regulationsdepends upon the risks inherent in the transaction concerned.See the note to paragraph 5.8 above on the relative robustnessof different categories of documents.A RISK BASED approach is key to successful compliance1. Evidence not obtained - reasons:-Client previously identified in: - Month Year.Client identified personally by - NamePositionOther - state reason fullyA. Evidence obtained to verify identity (see para. Above)Valid national PassportValid photocard national driving licence (full or provisional)Valid (old style) full UK driving licenceArmed forces ID CardNational Identity Card (non-UK nationals)Firearms certificate or shotgun licenceIdentity card issued by the Electoral Office for Northern IrelandInstrument of court appointment (e.g. Appointment as liquidatoror grant of probate)Recent evidence of entitlement to state or local authority-fundedbenefit, tax credit, pension, educational or other grant.Building Society passbook.Credit Reference agency search.Utility bills.

(not ones printed off the internet)Mortgage statement.Council tax demand.Bank/Building Society/credit card statement. (but not ones printedoff the internet)Home visit to applicant's address.Check of voters roll.Suitable for proof of address only.B. NOTE: The FATF is an inter-governmental bodywhose purpose is the development and promotion of national andinternational policies to combat money laundering and terroristfinancing. Since its creation the FATF has spearheaded the effortto adopt and implement measures designed to counter the useof the financial system by criminals.

The principal objectiveof the NCCT initiative is to reduce the vulnerability of thefinancial system to money laundering by ensuring that all financialcentres adopt and implement measures for the prevention, detectionand punishment of money laundering according to internationallyrecognised standards.Section 10Specific Guidance to Nominated OfficersNow that you've accepted the responsibilities for implementingyour practice's anti-money laundering policies do you have an adequateset of procedures to meet the requirements of the anti-money launderinglegislation and your policy objectives?1.